Pune (Maharashtra) [India], November 18: Capitalizing on India’s accelerating financial growth story, Bajaj Finserv Asset Management Limited announced the launch of its Banking and Financial Services Fund, an open-ended equity scheme investing in Banking and Financial services sector. The New Fund Offer (NFO) opens for subscription on 10th November 2025 and closes on 24th November 2025. The fund is benchmarked against the NIFTY Financial Services TRI.

- An open ended equity scheme investing in Banking and Financial Services sector

- The fund will invest in 45–60 stocks shortlisted from a 180-200 megatrends universe of the Banking, NBFC, Insurance, Capital market intermediary, and asset management companies

India’s Banking and Financial services (BFSI) sector is transforming at an unprecedented pace, expanding well beyond traditional banking to include NBFCs, insurers, AMCs, capital markets, and cutting-edge fintechs. Over the past two decades, the sector’s market capitalization has skyrocketed nearly 50X#, powered by rapid digitization, rising credit penetration, financial inclusion, and bold regulatory reforms. Today, the sector stands at the heart of India’s economic momentum, offering investors a gateway to participate in the country’s financial transformation and long-term wealth creation story.

Built on Bajaj Finserv Mutual Funds’ Megatrends strategy, the fund aims to capture opportunities from India’s evolving financial ecosystem through a diversified portfolio spanning banks, NBFCs, insurers, AMCs, and other capital market participants. It will invest in 45–60* stocks shortlisted from a ~180-200-stock Megatrends universe aligned with long-term structural trends.

Backed by megatrends such as UPI adoption, digital lending, Jan Dhan initiatives, and rising participation across NBFCs, mutual funds, and insurance, this scheme is designed for long-term investors with a higher risk appetite seeking wealth creation through focused exposure to the BFSI sector.

Ganesh Mohan, Managing Director, Bajaj Finserv Asset Management Limited, said, “As India marches toward Viksit Bharat and becomes a Top 3 economy globally, the financial services sector will play a significant role in enabling this growth. India’s increasing affluence and aspirations will drive significant growth across different financial services like lending, insurance, investments, payments and capital market products. BFSI will increasingly be central to India’s growth & will attract both domestic and foreign pools of capital as the economy expands. We believe this gives investors a great opportunity to participate in this megatrend through a dedicated thematic fund which will identify opportunities across the entire financial services spectrum and look to benefit from the future growth in these sectors.”

Nimesh Chandan, CIO, Bajaj Finserv Asset Management Limited, said, “Our investment approach for the Bajaj Finserv Banking and Financial Services Fund is anchored in rigorous research and disciplined stock selection. The fund will invest in 45–60 curated companies from a universe of 180-200 megatrends powered companies, across banking, NBFC, insurance, capital market intermediary, and asset management segments, ensuring both breadth and depth of exposure. While the sector offers multiple growth avenues, we believe superior outcomes are achieved by identifying businesses with sustainable competitive advantages, prudent capital allocation, and strong governance. By focusing on quality and maintaining a long-term orientation, we aim to deliver consistent risk-adjusted returns while giving investors access to the most compelling opportunities within India’s evolving BFSI landscape.”

The equity portion of the fund is managed by Mr. Nimesh Chandan (CIO) and Mr. Sorbh Gupta (Head- Equity), while its debt investments are managed by Mr. Siddharth Chaudhary (Head- Fixed Income). The minimum application amount is ₹500 (Plus multiples of Re.1), with a minimum additional application of ₹100 (Plus multiples of Re.1). An exit load of 1% is applicable if the investment is redeemed within three months of the date of the allotment. The fund offers both Growth and IDCW (Income Distribution cum Capital Withdrawal) options.

*The portfolio count is indicative, and actual number will depend on market conditions at the time of making investment.

Source: #As mentioned in the fund scheme deck

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

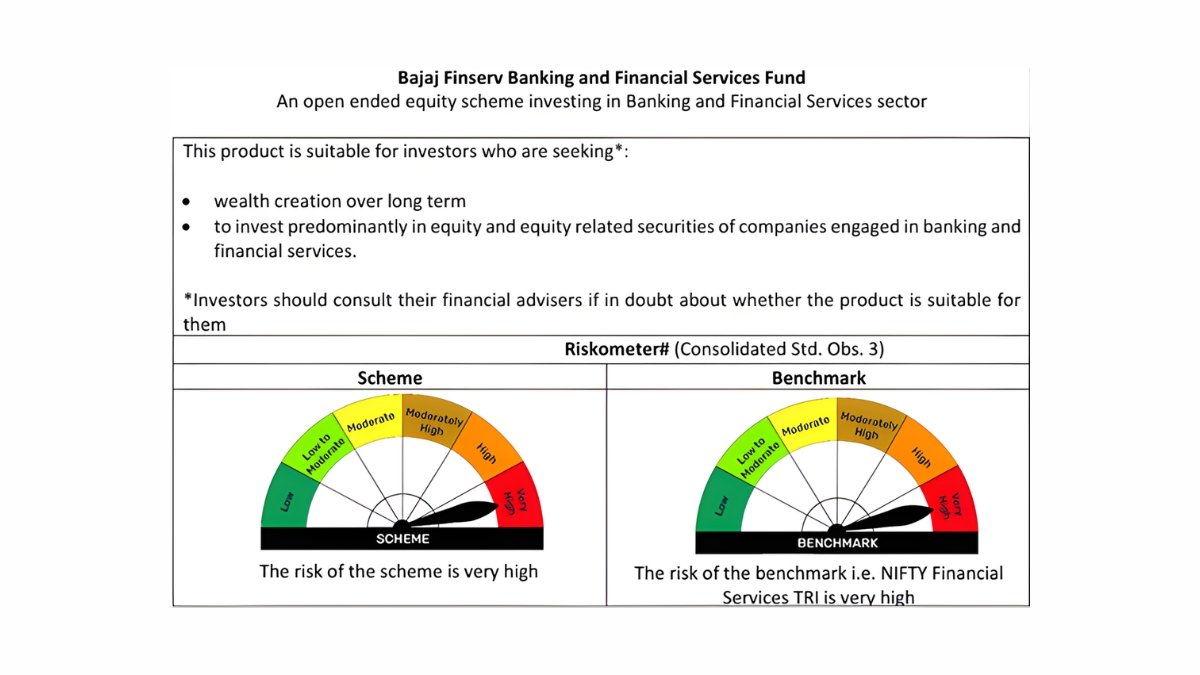

#The above product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them

About Bajaj Finserv Asset Management Limited

Bajaj Finserv Asset Management Limited (BFAML) is a 100% subsidiary of Bajaj Finserv Limited. Backed by one of India’s most respected brands, BFAML is set to offer an array of innovative investment solutions using a differentiated approach to investing, including but not limited to, mutual funds (equity, debt, hybrid), portfolio management services and alternative investment funds, subject to regulatory approval. With a future-focused investment strategy, it aims to help every Indian achieve life’s financial goals.

To know more, visit www.bajajamc.com