New Delhi [India], February 18: ATD Finance has announced a strategic partnership with ATD Money to provide instant salary advances for corporate employees, ensuring quick access to emergency funds without employer intervention. This collaboration aims to bridge the gap in financial accessibility by offering seamless, short-term loan solutions through a fully digital process.

With many companies restricting salary advances due to internal policies, employees often struggle to manage unexpected expenses. Through this partnership, ATD Finance and ATD Money enable salaried professionals to avail unsecured loans ranging from ₹3,000 to ₹50,000. The loan tenure is flexible, extending from 91 to 365 days, with quick approvals and immediate disbursement, ensuring that financial emergencies do not disrupt daily life.

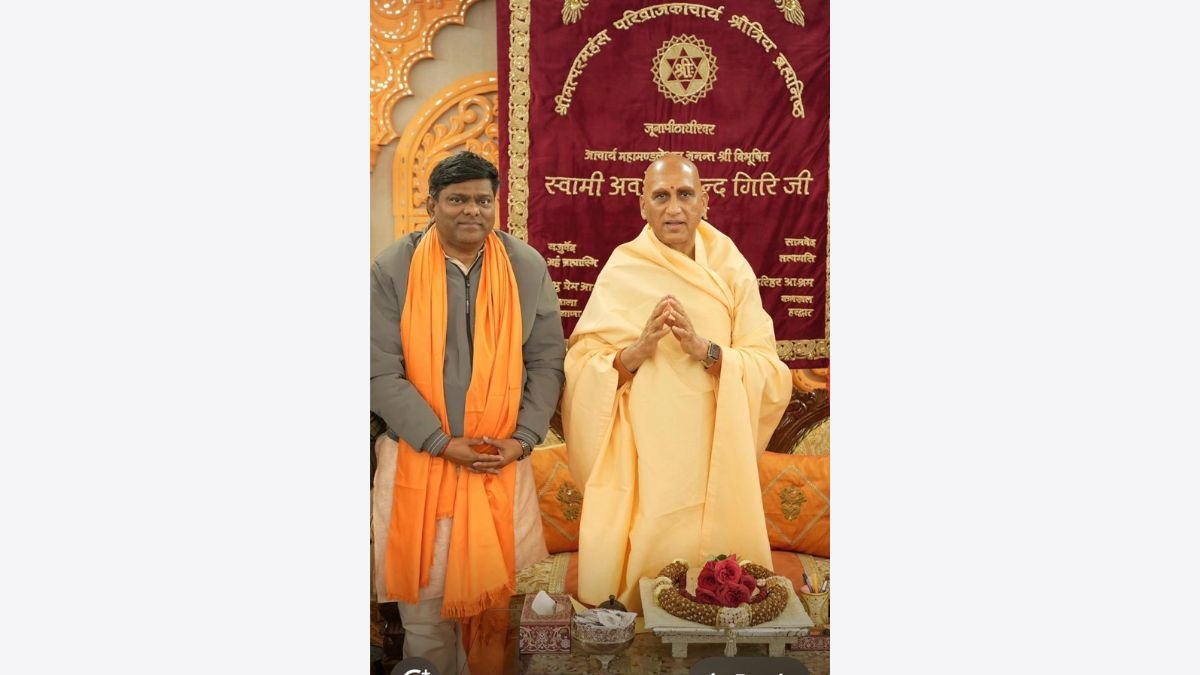

Speaking on the partnership, Dr. Manoranjan Mohanty, CEO, ATD Group said , “Our collaboration with ATD Money reflects our commitment to providing financial solutions that empower working professionals. By leveraging technology, we aim to eliminate the stress associated with short-term cash shortages and promote financial well-being through swift, transparent, and hassle-free loan disbursements.”

In a rapidly evolving corporate landscape, financial flexibility is essential for employees managing monthly expenses, medical emergencies, or unexpected financial obligations. However, many organizations lack provisions for advance salaries, leaving employees dependent on high-interest credit cards or informal lending options.This partnership addresses this challenge by offering an easy-to-access alternative that ensures financial stability. The online platform allows applicants to complete the loan process with minimal documentation, reducing paperwork-related delays. The approval mechanism is optimized for efficiency, ensuring disbursement within hours.

A Step Towards Digital Financial Inclusion

The partnership aligns with India’s growing shift toward digital financial services, where quick access to funds is becoming a necessity. By integrating automated approval systems, AI-based credit assessments, and paperless transactions, ATD Finance and ATD Money ensure a streamlined borrowing experience.

For salaried professionals, the benefits include:

Instant loan disbursement – Funds are credited directly to the borrower’s account upon approval.

No collateral required – Unlike traditional loans, employees do not need to pledge assets.

Flexible repayment options – Borrowers can select tenure periods that suit their financial planning.

Minimal documentation – The process requires only essential KYC details, reducing complexity.

As digital lending gains momentum in India, collaborations like this play a crucial role in enhancing financial resilience for corporate employees. The seamless integration of fintech solutions in lending services simplifies access to credit, helping professionals maintain their financial well-being.

About ATD Finance and ATD Money

ATD Finance is a leading non-banking financial company (NBFC) in India, offering a wide range of financial services, including personal loans, microfinance solutions, and secured loan options. The company focuses on creating customer-centric financial products that cater to diverse financial needs.

ATD Money specializes in digital lending, providing instant personal loans and payday loans through a user-friendly online platform. The company’s goal is to offer quick, accessible, and efficient financial assistance to salaried professionals in need of short-term credit solutions.

This partnership aims to redefine the lending experience for salaried professionals, ensuring they have access to timely financial support without bureaucratic hurdles.

App Link: https://play.google.com/store/apps/details?id=com.atdmoney.atdapp&hl=en_IN

For more information please visit: www.atdfinance.in or www.atdmoney.com.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.