New Delhi [India], July 14: Board of Directors of Bluegod Entertainment Limited (BSE – 539175), formerly known as Indra Industries Limited, is scheduled to meet on 16th July 2025 to consider and approve the proposal for stock split/subdivision of equity shares of the company. Currently face value of the company share is Rs. 10 per share. The stock split will be subject to approval of the Shareholders and such authorities as may be required under Section 61 of the Companies Act, 2013.

Bluegod Entertainment Limited continues to register an upward momentum financially. The company reported a robust financial performance for the quarter and year ended March 31, 2025. Annual sales rose by 511% to Rs. 2.30 crore from Rs. 45 lakhs in FY24. Net profit for FY25 was Rs. 1.82 crore in FY25, 10 10-fold increase from Rs. 0.17 crore net profit in FY24. For Q4 FY25 alone, the company recorded Rs. 2.04 crore in net revenue and Rs. 1.87 crore in net profit. This reflects solid quarter-on-quarter growth backed by stronger performance across business verticals.

Company continues to make significant strides in its transformative journey. The company is expanding its footprint in the entertainment sector through new film acquisitions, regional content ventures, and high-impact intellectual properties, while maintaining strong financial growth and strategic direction.

Highlights:

- For Q4 FY25, revenue stood at Rs. 2.04 crore with net profit of Rs. 1,87 crores

- Successfully raised Rs. 48.57 crore via rights issue of 4.86 crore equity shares at Rs. 10 per share

- Funds raised to support working capital and general corporate purposes

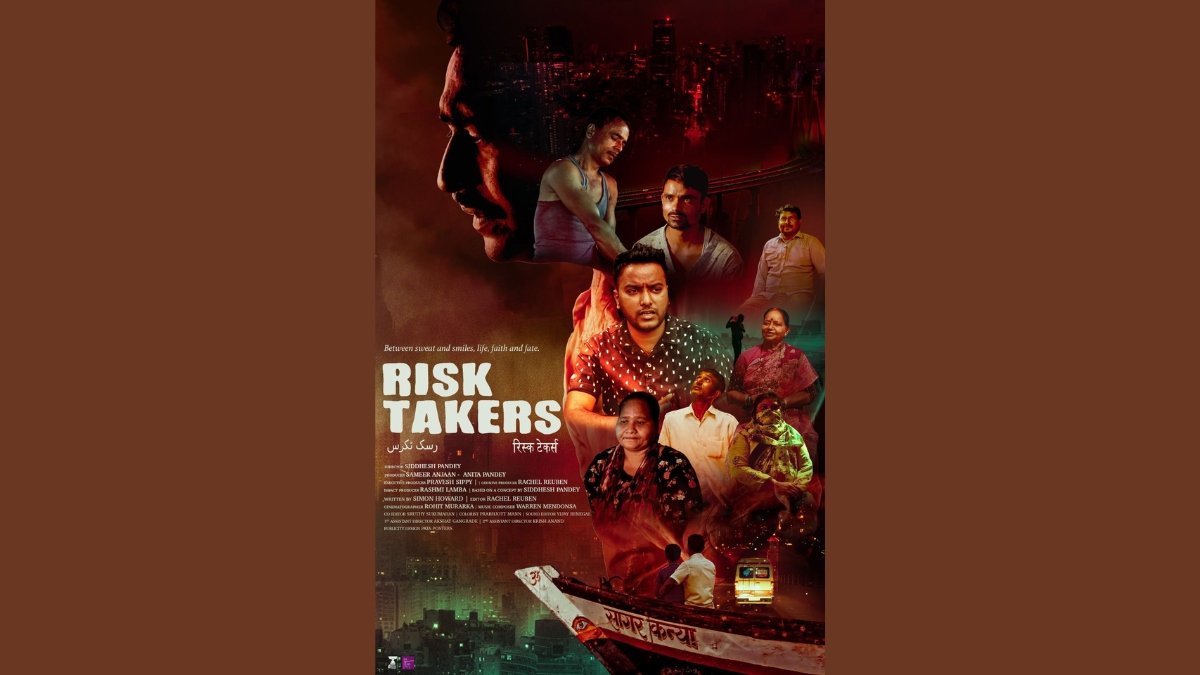

- The company has ventured into the entertainment sector and has bought rights for a few feature films

To fuel its expansion plans, the company recently completed a Rights Issue, raising Rs. 48.57 crore through allotment of 4,85,78,025 equity shares at a fixed price of Rs. 10 per share. The rights entitlement ratio for the rights issue was 15:2 (15 Rights Equity Shares for every 2 fully paid-up Equity Shares held on the Record Date of May 15, 2025). The issue was approved by the Board, and allotment was completed on June 23, 2025. The company also voluntarily appointed a SEBI-registered Credit Rating Agency to monitor the utilization of funds in accordance with SEBI (ICDR) norms. The issue was listed on June 16, 2025 and was oversubscribed by 1.06 times. The proceeds from the issue.

The proceeds from the rights issue will be deployed to augment the existing and incremental working capital requirements of the company and for general corporate purposes.

The company has diversified its portfolio and entered the entertainment industry with a focus on regional content. Bluegod Entertainment Limited has recently engaged in multiple film agreements. The company acquired the film “Roti Kapda aur Internet” from Laddu Gopal Ventures Private Limited. The company also secured the rights for two Gujarati films from Artment Films Limited: “Pressure” for Rs. 80 lakhs and “Choranta” for Rs 1 crore. Lastly, Bluegod Entertainment Limited also finalised a production agreement with Rajpal Naurang Yadav Ventures Pvt. Ltd. for the feature film “Nannhen Ki Shaadi,” with a budget of Rs. 2 crores.

About Bluegod Entertainment Limited:

Established in 1984 and headquartered in Indore, Bluegod Entertainment Limited (formerly Indra Industries Limited) has evolved from its core manufacturing operations to include entertainment and media ventures. They are the leading manufacturer of Single Super Phosphate (SSP) fertilisers and have also diversified into polymers, producing HDPE and PP woven sack bags for sectors like cement and fertilisers. With a renewed strategic focus and ongoing expansion, the company aims to position itself as a key player in both segments.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.