The intersection of finance and technology continues to redefine investment management, prioritizing clarity, focus, and discipline over traditional, purely discretionary methods. In a significant market development, JioBlackRock has launched a new Flexi Cap Fund, marking the debut of India’s first active equity fund underpinned by the Systematic Active Equity (SAE) approach.

This is an open fund that can be subscribed to until the 7th of October and is a direct reaction to the rising volatility and information overload that are the hallmarks of modern markets. With the emerging world economies competing through changing dynamics of trade and advancement in technology, the capacity to process large quantities of information and transform it into useful investment indicators is a key distinction.

Systematic Active Equity: A New Paradigm for Decision Making

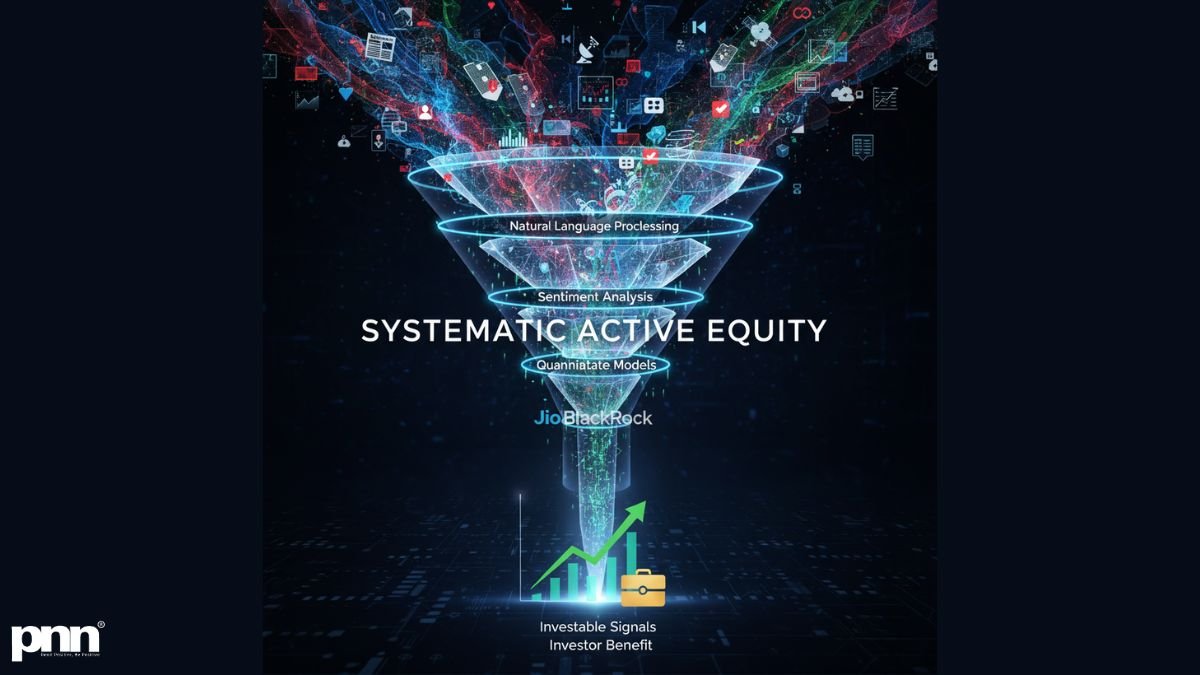

Rishi Kohli, CIO of JioBlackRock Mutual Fund, highlights the Systematic Active Equity (SAE) methodology as the core engine of the new fund. SAE is a sophisticated hybrid investment model that marries the quantitative rigor of systematic strategies with the insights and flexibility of active management. It is not merely a quantitative fund, but a data-enhanced active strategy.

The SAE methodology is essentially concerned with guaranteeing the consistency and eliminating human biasness in the signal-to-investment cycle. The system is, essentially, a highly sophisticated algorithm and technology that constantly scans, analyzes and interprets a great number of data points, such as news flow, market sentiment, macroeconomic variables, and company fundamentals.

The advantage is obvious: The system assists the fund house to know exactly what news, article, or signal to select and allocate to investments, thus doing more to build the credibility of investors in the analytical power of the fund. This systematic vetting process filters out the noise, and the investment team is left to work on those signals that have a statistically significant relationship with future stock performance without ever losing optimism for long-term growth.

Discipline in the Age of Information Overload

The amount of information which surrounds us nowadays is overwhelming. It is a titanic and uneven undertaking for a traditional active manager to sort through daily market reports, news coverage, and economic releases to discover one useful piece of information. This is where the SAE framework comes into play by providing a strict discipline to the information flow.

- Objective Signal Extraction: The SAE system quantifies soft information, such as sentiment from news reports, turning qualitative data into measurable inputs. This introduces an objective layer to fundamental analysis.

- Risk Management and Consistency: The SAE approach of codifying the rules of investment guarantees that the decisions made are on the basis of non-prejudiced, back-tested rules. This stability is important in controlling the portfolio risk and eliminating the act of impulsive and emotional trading that mostly affects traditional discretionary funds.

- Scalability of Research: The technology can enable the fund management team to process efficiently thousands of companies and hundreds of events across the world in parallel, something that cannot have been achieved by human analysts alone. This is due to its broad coverage, which provides the fund with the ability to pursue opportunities in the total flexi-cap spectrum (large, middle, and small-cap stocks).

“Successful investing today requires embracing technology to cut through the fog of information,” a prominent financial journalist recently commented, noting the sector’s shift toward hybrid models. The Systematic Active Equity approach championed by JioBlackRock is a prime example of this evolution. It allows human expertise to concentrate on strategy and oversight, while the systematic tools handle the heavy lifting of signal processing.

Structured and Focused Market Entry

The fund’s initial subscription window, open until October 7th, offers investors a structured entry point. Following the allotment date, the fund will transition to a continuous sale and repurchase mode within five business days, which aligns with standard mutual fund operational procedures.

To investors, what is important is that there is a guarantee of a process that is grounded in clarity and analytical depth. With an option of an investment through a Systematic Investment Plan (SIP) or a lump sum, it is still guaranteed that the capital allocation decision is technologically advanced. It is an inherently positive structural gain, a hybrid of the adaptability of a flexi-cap mandate and the computing capabilities of SAE, meant to produce a healthy and sturdy portfolio intended to compound over the long term.

The launch signifies a maturing of the Indian mutual fund industry, embracing global best practices in quant-enhanced active management to deliver a more disciplined and consistent outcome for its investors.