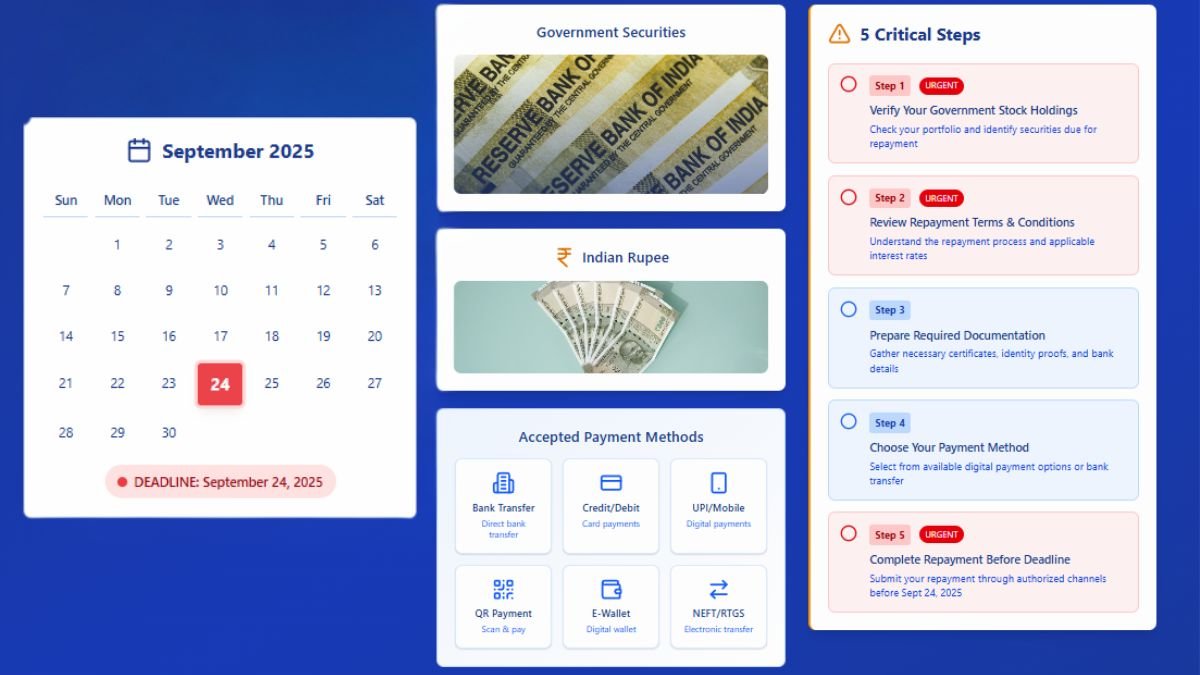

The Reserve Bank of India has issued a comprehensive press communiqué on September 4, 2025, outlining the repayment procedures for the ‘8.20% GOVT. STOCK 2025. Investors in these government securities, having a maturity date of September 24, 2025, need to be aware of the essential requirements and the processes that have to be followed to repay their investments without any problems.

The remaining balance of the 8.20% Government Stock 2025 will be repaid at the value of par on the mentioned maturity date. The announcement offers relief to thousands of investors who hold these securities in their fixed-income portfolios.

Understanding the Repayment Timeline and Interest Cessation

The government stock 2025 repayment will be made exactly on September 24, 2025, and there will be no interest on the same after this time. Such a suspension of interest payments highlights the significance of bondholders taking prompt steps in order to conclude formalities.

Where September 24 is a holiday as proclaimed by any State Government under the Negotiable Instruments Act, 1881, then repayment will be made on the prior working day. This provision also gives the investors the assurance that their money is not withheld needlessly by any regional holiday differences.

The announcement of the RBI stresses the decisiveness of the date of repayment, and therefore, the investor needs all the necessary documents ready beforehand.

Electronic Payment Methods and Bank Account Requirements

The Government Securities Regulations, 2007, namely, sub-regulations 24(2) and 24(3), require that the repayment proceeds to registered holders shall be effected by use of electronic processes or pay orders. This is a digitized practice that is consistent with the government’s efforts of digital payments.

Investors of securities in Subsidiary General Ledger (SGL) accounts, Constituent Subsidiary General Ledger (CSGL) accounts or Stock Certificates are required to submit their bank account details well in advance. The payment will be made either through pay orders incorporating relevant bank details or direct credit to the holder’s bank account with electronic fund receipt facilities.

“The electronic payment system ensures faster and more secure transactions for government security holders,” according to banking sector experts familiar with the process. This digital-first approach reduces processing time and minimizes the risk of payment delays.

Alternative Repayment Procedures for Manual Processing

For investors who cannot provide electronic payment details, alternative arrangements have been established. These holders may tender their securities, properly discharged, at designated paying offices 20 days before the maturity date.

The approved paying offices include:

- Public Debt Offices

- State Treasuries and Sub-Treasuries

- State Bank of India branches where securities are enfranchised or registered

This 20-day advance submission requirement allows sufficient processing time for manual payments and ensures that all investors receive their repayment on the scheduled date.

Critical Action Items for Bondholders

Investors must take immediate action to avoid repayment complications. The first priority involves submitting complete bank account particulars to the relevant authorities. This submission should include account numbers, IFSC codes, and proper authorization mandates.

For those opting for manual processing, securities must be properly discharged and submitted to authorized paying offices by September 4, 2025 – exactly 20 days before maturity. Late submissions may result in delayed payments beyond the official maturity date.

Investors should verify their securities’ enfacement status and confirm which specific SBI branch or government office handles their particular holdings. This information is typically available on the original certificates or through previous interest payment records.

Impact on Investment Portfolios and Market Dynamics

The repayment of the government stock 2025 is a huge liquidity event in the government securities market in India. This repayment will inject a lot of liquidity into the financial system as billions of rupees of outstanding securities mature.

Portfolio managers and institutional investors have been gearing up for this maturity by modifying their fixed-income allocations. The higher interest rate environment of past years is expressed by the 8.20 percent coupon rate that was attractive at the time of issue.

The reinvestment option should be considered by individual investors as they get the funds. Existing government securities give varying yield profiles, and financial advisors suggest that one has to analyze new investment opportunities in the current market conditions.

The methodical nature of such repayment goes to prove that the government is willing to repay the debt in due time. This certainly gives India its own sovereign credit rating, and keeps government securities as an asset class on the menu of investors.

Investors are requested to contact their registered paying offices directly to acquire detailed procedures and other particular requirements. The press communiqué released by the RBI is transparent and clear on the direction to take by all stakeholders in this momentous repayment episode.