Mumbai (Maharashtra) [India], February 05: Travels & Rentals Limited, a BSE SME-listed travel services company, has announced a Rights Issue worth Rs 16.80 crore, aimed at strengthening its working capital position and supporting general corporate requirements. The company’s rights issue will open on February 5, 2026 and close on March 6, 2026, as per information shared by the company.

The record date for determining eligible shareholders has been fixed as January 28, 2026. The issue will be offered in the ratio of 1:1, meaning shareholders will be entitled to apply for one equity share for every one equity share held as on the record date.

Issue details and pricing

The rights issue is priced at Rs 15 per equity share, with a face value of Rs 10 per share. The total issue size is Rs 16,80,40,275, making it one of the notable fundraising initiatives in the BSE SME segment for the travel and tourism services sector.

Rights issues are generally seen as a shareholder-friendly fundraising method, allowing existing investors the first right to participate in capital raising while maintaining their ownership stake, if they choose to subscribe.

The company has also highlighted that the last date for on-market renunciation of Rights Entitlements (REs) is March 2, 2026. Rights entitlements are tradable instruments credited to eligible shareholders, enabling them to either subscribe to the issue or sell the entitlements on the stock exchange during the renunciation period.

Use of proceeds: Working capital in focus

The company plans to deploy the proceeds largely towards working capital needs, which is critical for travel service businesses that handle frequent bookings, vendor payments, and operational cash cycles.

According to the stated objectives, the issue proceeds will be utilised as follows:

Working Capital Requirements: Rs 1,205.40 lakh

General Corporate Purposes: Rs 400 lakh

Estimated Issue-related Expenses: Rs 75 lakh

Total Issue Proceeds: Rs 1,680.40 lakh

Industry experts note that working capital availability is especially important for travel companies as the sector experiences fluctuations in demand, seasonal booking trends, and increasing customer expectations for seamless services.

Company background and operations

Travels & Rentals Limited, established in 1996, brings more than 25 years of experience in the travel services industry. The company is promoted by founding promoter Devendra Bharat Parekh and was listed on the BSE SME platform on September 5, 2024.

The company offers a broad portfolio of travel-related products and services designed to deliver end-to-end travel solutions. These include:

Airline ticketing

Hotel bookings

Tour packages

Rail tickets

Travel insurance

Passport and visa processing

Other travel-related value-added services

With a diversified service basket, the company aims to cater to both leisure and business travellers while supporting customers with travel documentation and additional services that are increasingly becoming part of integrated travel offerings.

Accreditations and industry memberships

The company is accredited by the International Air Transport Association (IATA), and is also recognised by the Ministry of Tourism, Government of India. It is a member of prominent travel trade bodies including:

TAAI (Travel Agents Association of India)

IATO (Indian Association of Tour Operators)

Such accreditations and memberships are often considered important credibility markers in the travel industry, supporting relationships with airlines, vendors, and institutional partners.

Promoters and management

Travels & Rentals Limited is promoted by Devendra Bharat Parekh, Karuna Parekh, Anupama Singhi and Tushar Singhi.

The company’s management team includes:

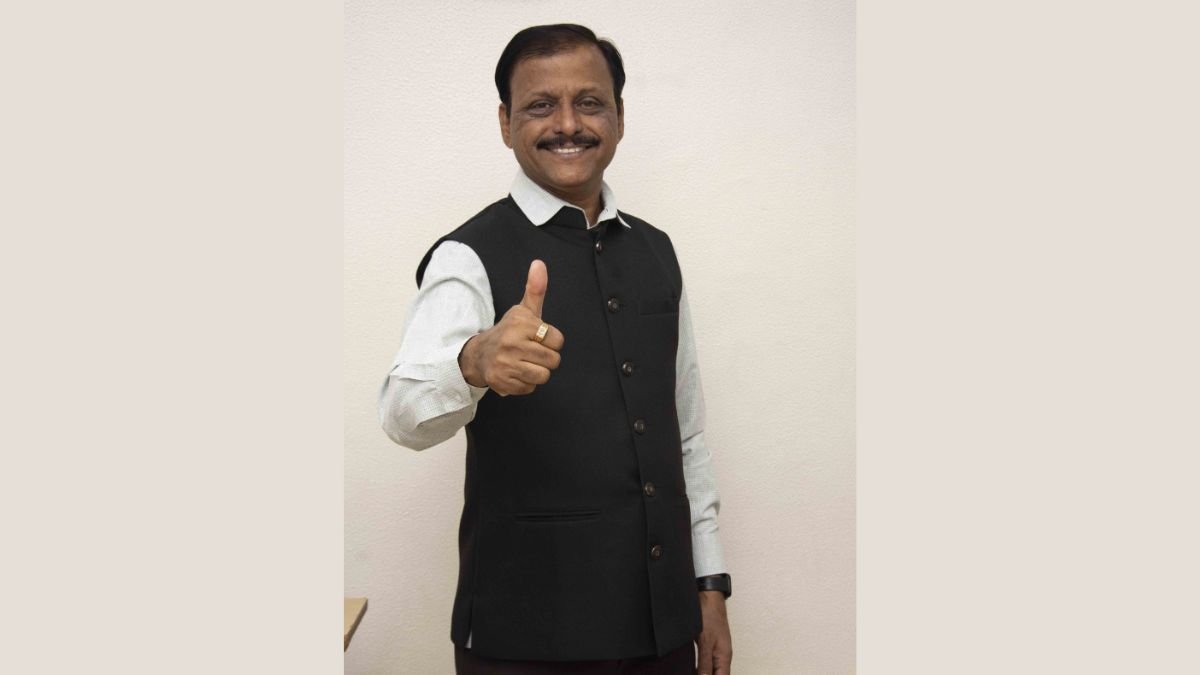

Devendra Bharat Parekh – Promoter & Managing Director

Tushar Singhi – Executive Director

Anupama Singhi – Non-Executive Non-Independent Director

Ballari Bhattacharya Sengupta – Non-Executive Independent Director

Sailendra Kumar Das – Non-Executive Independent Director

Sayad Aziz Ahmad – Chief Financial Officer

Jaya Jain – Company Secretary & Compliance Officer

Corporate observers point out that a structured leadership team and compliance function becomes increasingly significant for SME-listed companies as they expand scale and engage with public investors.

How shareholders can apply

The company stated that the rights issue will be available through the ASBA (Applications Supported by Blocked Amount) mechanism, which is a standard method for subscribing to rights issues and IPOs in India.

Shareholders can apply in two ways:

1) Online application via net banking (if supported by bank)

Eligible investors can apply through the ASBA section in their bank’s net banking portal by selecting the rights issue and entering key details such as:

DP ID/Client ID

Number of entitled shares

Additional shares applied for (if any)

Upon submission, the bank blocks the application amount in the investor’s account until allotment is finalised.

2) Physical application through SCSB branch

Investors unable to apply online may submit the Composite Application Form (CAF) physically at the branch of a Self-Certified Syndicate Bank (SCSB). The company noted that eligible shareholders will receive the CAF through courier from the company’s Registrar and Transfer Agent (RTA).

In case a shareholder does not receive the CAF, the form can also be downloaded from the BSE website.

Rights entitlements: tradable opportunity

A key feature of the issue is the Rights Entitlements (REs), which will be credited to shareholders’ demat accounts based on their holdings on the record date.

These REs can be:

Used to subscribe to the rights issue

Sold on the stock exchange during the renunciation period

Purchased by non-eligible investors, who can then apply for rights shares after acquiring REs

This system enables market participation even for investors who were not shareholders on the record date, provided they purchase the REs on the exchange.

Financial performance snapshot

The company also shared financial highlights across periods including limited reviewed and audited results.

For the period ending September 2025 (Limited Reviewed), the company reported:

Revenue: Rs 465.31 lakh

Total Income: Rs 495.31 lakh

Profit After Tax: Rs 155.94 lakh

For FY25 (Audited):

Revenue: Rs 1,145.32 lakh

Total Income: Rs 1,205.45 lakh

Profit After Tax: Rs 321.84 lakh

For FY24 (Audited):

Revenue: Rs 752.83 lakh

Total Income: Rs 803.54 lakh

Profit After Tax: Rs 296.55 lakh

The company’s reported financials indicate consistent profitability, though investors typically evaluate SME travel companies with attention to demand cycles, operational costs, and cash flow management.

The rights issue comes at a time when travel demand in India continues to evolve with rising domestic tourism, growing preference for packaged services, and increased use of integrated travel support like insurance and visa facilitation.

For Travels & Rentals Limited, the capital infusion is expected to support its working capital needs and strengthen its ability to serve customers across travel categories while maintaining business continuity and scalability in a competitive marketplace.

If you object to the content of this press release, please notify us at pr.error.rectification@gmail.com. We will respond and rectify the situation within 24 hours.