Mumbai (Maharashtra) [India], July 24: AIF is a privately pooled investment vehicle that collects money from private investors, and usually includes private equity, hedge fund, venture capital, angel fund, etc. Investors who want to diversify their portfolio can choose Alternative Investment Fund to grow their wealth. Traditionally, alternative asset classes have been dominated by institutional investors, family offices, and ultra-high net worth individuals (UHNIs), but of late many more have shown their interest in the segment as it has shown its trajectory growth.

AIFs make for lucrative investments and many a time its returns are mindboggling with over 100x.Covid-19 has also invariably changed the investment patterns. An increase has been witnessed in allocations to alternative investments. According to the latest data available with market regulator SEBI, the cumulative net investments made by AIFs at the end of March 2021 stood at Rs 2-lakh crore against Rs 1.53-lakh crore at the end of the previous fiscal.AIF’s can be great portfolio diversifiers and help mitigate risks, generate passive income as they offer safer yields, and to some extent tax-efficient.

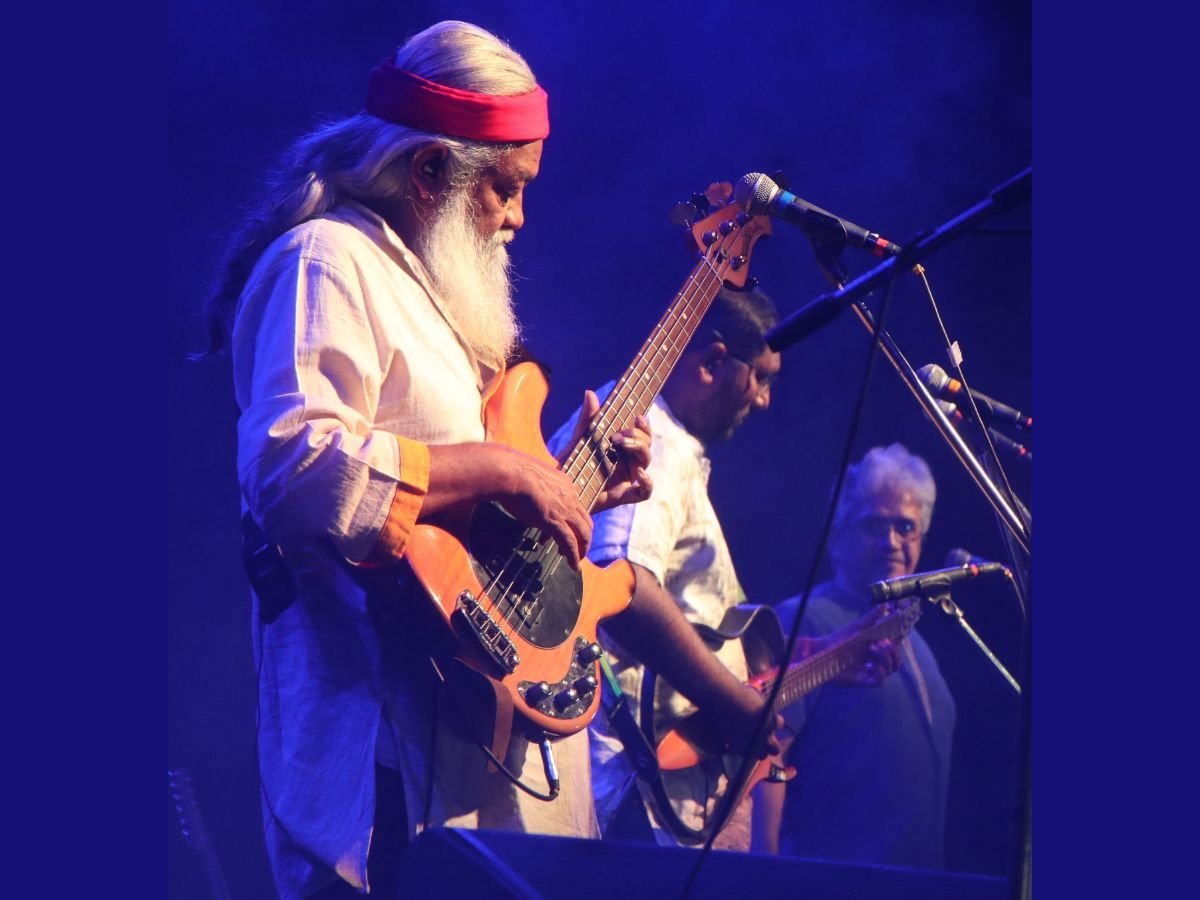

Darwin Platform Group of Companies under the visionary Leadership of Mr. Ajay Harinath Singh, Chairman (In Pic.), a lineage of Lava (Son of Lord Rama) with massive interest in the areas of Retail, Infrastructure, Logistics, IT, Refineries, Shipping, Automobile, Mining, Power and Pharma along with Mr. Munindra Kumar, DG CCI India and with the active participation of retired senior-most bureaucrats and Industry veterans from a varied background like World Bank, Digital Transformation, Financial Inclusion, Agritech, G2C, etc. launched AIF (Alternative Investment Fund) called DEURASIA to take the vision of Hon. PM Modi’s vision of enabling Startups in various sectors and contribute toward the 5 Trillion USD economy.

DG, CCI India, retired senior-most bureaucrats and Industry veterans will contribute only to raising the Fund through AIF with the active participation of Financial Institutions, UHNI, Family Offices, Sovereign Fund, Multilateral Agencies, Government Agencies, and IFC.

The raised amount will be invested into Startups with specific sectors – Retail, Fintech, Agritech, Logistics, Digital Transformation, and Healthtech besides other path-breaking ideas. The expected investment is expected to yield over 10x return and the investment committee will ensure the investment will be path-breaking for the overall socio-economic development in the sectors.

The global startup economy remains large, creating nearly $3 trillion in value, a figure on par with the GDP of a G7 economy. Seven out of the top 10 largest companies in the world are in technology — the highest concentration of any industry sector among the top global companies and 2019 saw close to $300 billion in venture capital investments around the world. India is home to the third-largest Startup ecosystem and over 54 Unicorns.

Incubators and Accelerators (I/A) played an important role in this growth by mentoring start-up founders, nurturing ideas, providing technical support, helping them generate funds, and acquiring new customers. The Group is collaborating and initiating over 15 Incubators and Accelerators in this financial year making it one of the most varied portfolios in the country as it sync with our vision of opportunities for all.

Indian startups raised $7.8 billion in the first four months of 2021

Global investors see growing opportunities in the country’s startup scene. The nation of 1.4 billion people has seen the rapid adoption of smartphones in recent years, the explosive growth of inexpensive internet services, and a new generation of ambitious entrepreneurs. Looking to empower over 5 Lakhs Farmers through IT-driven initiatives and Market linkages with Logistics enablement, the group is making inroads in the sector to tap its potential besides over 10000 retail outlets creating over lakhs of employment.

Covid19 has desperately made us think for the affordable Healthcare system in countries catering to the remotest part and giving access to the technology-driven affordable Healthcare with best-in-class features drawn from the various part of the globe and integrated for the local access and advantage. Group is already into the pharma segment and moving leap and bound to be the global leader in the sector.

Under the CSR activities, the group contribution is widely accepted by Industry veterans, Governments, and People at large as it syncs with the group vision of sharing knowledge and wealth.