Surat (Gujarat) [India], August 5: In a quiet corner of Gujarat’s Surat district, something extraordinary unfolded. Not a festival, not a rally, but a campaign with the power to change lives. For three months, the Agasi branch of Union Bank of India became a beacon of financial empowerment. On July 25, 2025, that campaign reached a stirring culmination.

What began as a government directive, the Financial Inclusion Saturation Campaign, turned into a grassroots movement, stitched together with resolve, outreach, and remarkable coordination. Guided by the Ministry of Finance and powered by Union Bank’s local and regional leadership, the campaign didn’t just check boxes. It opened real doors.

In India, the words “Jan Dhan” have come to mean more than just savings accounts. They signify opportunity, the first step for a farmer, a tailor, or a daily wage worker to finally enter the formal economy. That’s precisely what happened in Agasi.

For communities that have long existed at the financial margins, this wasn’t just another initiative. It was a bridge. Hundreds were enrolled under the Pradhan Mantri Jan Dhan Yojana (PMJDY), many for the first time. No more relying on cash under mattresses or informal lenders with exploitative rates. Now, these citizens had access to bank accounts, insurance, and dignity.

You could say, in Agasi, financial inclusion stopped being a slogan and became a street-level reality.

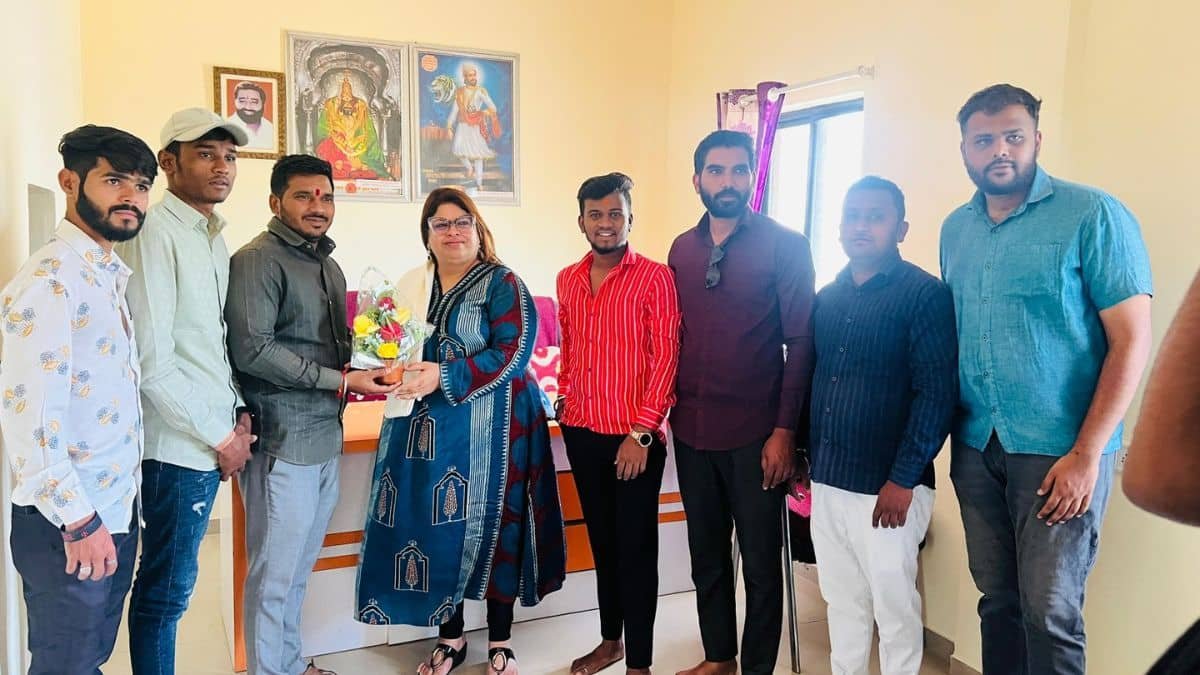

At the heart of this success story were individuals who didn’t just oversee the campaign, but owned it.

Shri Akhilesh Kumar, General Manager and Zonal Head of Gandhinagar Zone, stood tall at the final event, not as a figurehead, but as a champion of the cause. “Financial inclusion is not just a policy; it’s a pathway to national development and social equity,” he said. You could feel the sincerity in the way he thanked the Agasi branch staff, not with corporate politeness, but with real appreciation.

Joining him was Shri Bipin Kumar, Deputy Regional Head of RO Surat, whose operational insights made a real difference. His encouragement of “bottom-up solutions” and staff autonomy was more than motivational; it was strategic leadership in action.

Their presence on the ground wasn’t just symbolic. It signalled that from the zonal boardrooms to the rural branch counters, this campaign mattered.

Agasi may have been the focal point, but the ripple was felt across neighbouring branches. Heads from Vagaldhara, Dharampur, Chikhli, and Bilimora arrived, not just as guests, but as active contributors. They shared lessons, compared notes, and tackled challenges together.

It’s not every day you see bankers from different regions huddled together, not in competition, but in shared purpose. That, in itself, is a quiet revolution. The cross-branch collaboration led to harmonised messaging, improved outreach, and a replicable model others can follow.

The campaign also brought government-backed security schemes closer to home. For many, terms like “PM Jeevan Jyoti Bima Yojana” or “Atal Pension Yojana” were vague concepts. Now, they’re personal safety nets.

From ₹2 lakh life insurance covers under the PMJJBY, to accident protection through PMSBY, and future-proofing retirement via the APY, rural citizens were equipped with real financial cushions. These aren’t mere schemes; they are shields against life’s uncertainties, especially for those living on daily wages or in informal employment.

In effect, the campaign made complex systems simple and accessible.

Agasi’s campaign wasn’t flashy. It didn’t grab national headlines or trend on social media. But it made an impact that will last far longer.

This was a model built on ground-level awareness sessions, trust-building, door-to-door canvassing, and a patient explanation of why financial tools matter. It’s a model rooted in relationships, not just reach.

Union Bank of India has, in many ways, showcased what financial institutions can and should do when armed with the right intent, support, and structure.

Of course, campaigns end. But inclusion is a continuous journey. The next step? Ensuring these new account holders remain engaged through digital literacy, grievance redressal, and follow-up support. Access is only the beginning; usage is the real victory.

The success in Agasi is both a milestone and a mirror. It shows what’s possible when public policy meets genuine execution. And if replicated at scale, this could be the framework that finally closes India’s financial gap, not in theory, but in truth.