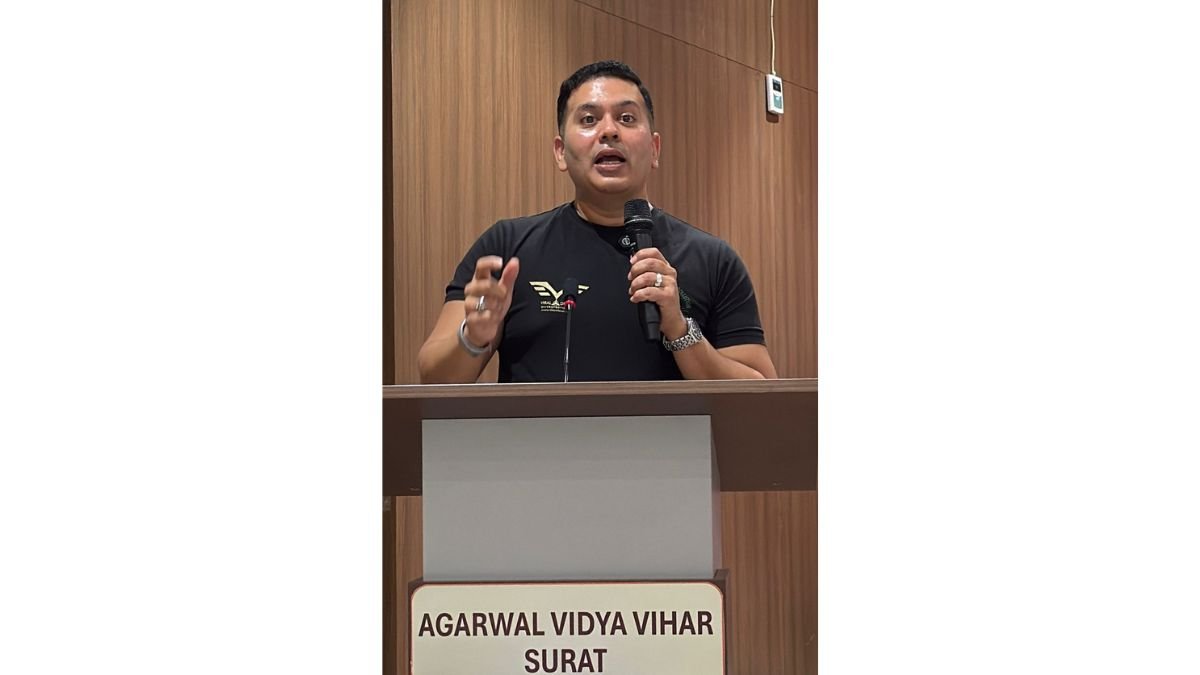

Mr. Rajiv Darji, Managing Director & CFO, “KCD Industries India Ltd”

Rights Issue priced at Rs. 18/- per share – 21% discount to share price of Rs. 22.83/- on 26th May 2023; Rights Issue will open from 31st May 2023 & close on 14th June 2023

Mumbai (Maharashtra) [India], May 30: KCD Industries India Ltd – one of the leading and Infra-Construction Company for Residential, Commercial & Institutional Buildings is scheduled to open its Rs. 48.85/- crore rights issue on May 31st 2023. The funds raised through the issue will be utilized to meet the working capital requirements to fund company’s expansion plans and for general corporate purposes. Right issue are offered at a price of Rs. 18/- per share – 21% discount to share price of Rs. 22.83/- per share on 26th May on BSE. Rights Issue will close on 14th June 2023.

The Company will issue 2,71,42,857 partly-paid equity shares of face value of Rs. 1/- each at a price of Rs. 18/- per rights share (including a premium of Rs. 17/- per Equity Share) aggregating to Rs. 48.85/- crore. The rights entitlement ratio for the proposed rights issue is 19:7; 19 rights equity shares of Rs.1/- each for every 7 equity shares of Rs.1/- each held by the eligible equity shareholders as on the record date – 19th May 2023. Shareholders will have to pay 25% – Rs 4.50/- per share on rights issue application and remaining 75% – Rs. 13.50/- per share on one or more calls as decided by the board. Last date for On-market Renunciation of Rights Entitlements is 9th June, 2023.

Highlights:-

- Funds raised through the rights issue will be used to meet working capital requirements for the company’s business activities and general corporate purposes

- The rights entitlement ratio for the proposed rights issue is 19:7; 19 rights equity shares of Rs. 1/- each for every 7 equity shares of Rs.1/- each held by the equity shareholders

- Company had fixed May 19th 2023 as record date for the purpose of determining the equity shareholders entitled to receive the rights entitlement in the rights issue

- Shareholders will have to pay 25% – Rs. 4.50/- per share on Rights Issue application and remaining 75% – Rs. 13.50/- per share on one or more calls as decided by the board

- Founded in 2007 by Mr. Rajiv Darji, KCD Group has emerged as a leader in the end-to-end construction services for Residential, Commercial, Institutional Buildings & Infra- Construction Industry within a short span

Commenting on the development, Mr. Rajiv Darji, Managing Director & CFO, KCD Industries India Ltd said, “Company has taken important strategic initiatives in the recent past with a focus to expand our footprints. Company has a vision to become one of the competitive Infrastructure company in India, in next five years, by consistently implementing Value Engineering Services towards the construction engineering design by providing required services creative Infrastructure for the development of real estate industries. We are confident that after the proposed rights issue, we will be able to execute our growth strategy in a manner that creates exponential value for all stakeholders. Proceeds of the issue will further strengthen company’s balance sheet and help fund its strategic growth initiatives.”

| Company received Rs. 23.82/- crore order for water supply project, Meerut (UP). Company has received work order for implementation of various rural water supply project in the Meerut district in the state of Uttar Pradesh for the Second cover agreement of 38 Village of Phase-2 Scheme Under Jal Jeevan Mission & State Water & Sanitation Mission, Lucknow-Uttar Pradesh amounting to Rs.23.82/- Crores |

| KCD Industries Limited has announced a bumper result in Q4FY23 Company has reported total revenue of Rs. 3.04/- crore against Rs. 73.45 lakhs in previous quarter registering a QoQ growth of 313.89%. Its Net profit has been Rs. 67.78/- lakhs. For the year ended 2023 company has registered a revenue of Rs. 3.92 crores with a net profit of Rs. 1.67 crores registering annual profit growth of 299%. Earnings Per Share has Increased to Rs. 1.62/- per share from Rs. 0.19/- per share a year ago. With an EPS of Rs. 1.62 the company is currently trading at an attractive price to earnings of Rs. 14.01/- crore. |

Incorporated in 2007, KCD Industries Ltd is in the business of real estate and construction. It has also expanded into Décor, Infra, Printing, Hospitality and Automobiles sectors in past. The Company has emerged as a leader in the end-to-end construction services for Residential, Commercial & Institutional Buildings, within a short span. The Company constructs high-rise buildings, gated communities & other buildings such as car park, corporate offices and infra, construction projects. The Company has a predominant presence in the Mumbai metropolitan region. The Company, in a short span of time, by leveraging technology & client relations, has been able to book orders worth more than Rs 210/- million comprising several Projects. The promoters have extensive experience, track record & command a vital position in the construction industry.

Company is debt free and has a reserve of Rs. 2.73/- crores on its books, with the upcoming right issue the capitalisation of the company will be enhanced and is expected to give robust quarters ahead. Promoter Group holding in the company is 48.71% as on 31st March 2023. For the quarter ended December 2022, company reported sales of Rs. 73/- lakh and Net Profit of Rs. 71/- lakh.

KCD Industries proposes to invest in the latest Infrastructure, tools, & construction technologies which will enable us to complete projects more efficiently in timely manner & with greater accuracy. Emerging as a niche player in the high-rise building construction market, KCD is planning to expand in all metros of India. KCD Industries plans for expansion its business in constructions of bridges & other relevant Infra-Development projects through strategic partnerships. Company offers support on complete MEP solution. Company has a high level of specialization & ability to successfully adapt modern technologies which it employs in all its projects on the field and also in its offices as support software for execution and management of projects.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.